Growth downshifts from sprint to sustainable

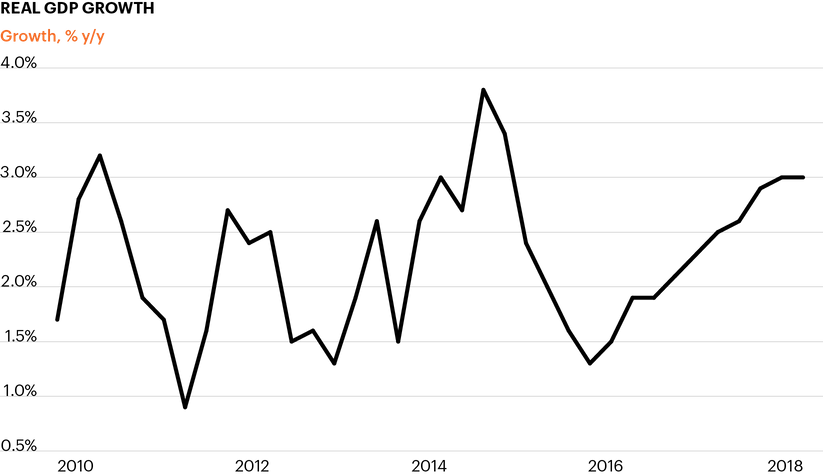

The U.S. economy is slowing down. The speed, depth and anatomy of the slowdown now become the focus for markets. The blistering pace of 2.9% growth in 2018 was unsustainable, and a deceleration closer to our potential growth rate around 2.0% has been widely expected. But weak data in the first quarter and yield curve inversion have raised concerns that growth could slow more sharply than expected, or even contract, resulting in a recession.

Source: Macrobond.

We are not forecasting a recession, and still believe growth around 2% is the most likely scenario for 2019. However, with the rest of the world slowing meaningfully and uncertainties creeping in, risks to growth are accumulating on the downside. This has important implications for investors. In 2015, growth decelerated sharply and we saw an “earnings recession,” and equities experienced a down year.

At the top of the list of what we are watching in Q2 – and the star of the show – is the consumer. Watching consumer confidence is key. Despite a strong labor market, consumer spending wavered at the end of 2018 as equity market volatility and the looming threat of a government shutdown impacted consumer sentiment. The bounce back has been uneven, making consumer confidence one of the most relevant leading indicators for both spending and the economy as a whole.

The housing market is another important pillar of growth that bears close watching in Q2. We see a housing sector that is decelerating but not collapsing. Much has been made about weakening demand for home sales, and construction data has been highly volatile since December. Looking ahead, offsetting factors may keep the sector treading water. Falling mortgage rates could give a boost to housing demand, while rising inventory supply may offer a headwind.

Finally, business investment is often seen as the vital swing factor that can make the difference between on-trend growth or a period of sluggish growth that falls short of a recession but weighs on the overall economic outlook. We expect business investment to soften throughout the year. We look at the factors that could determine how adventurous businesses are with capital spending projects.

Interest rates dig in at historic lows

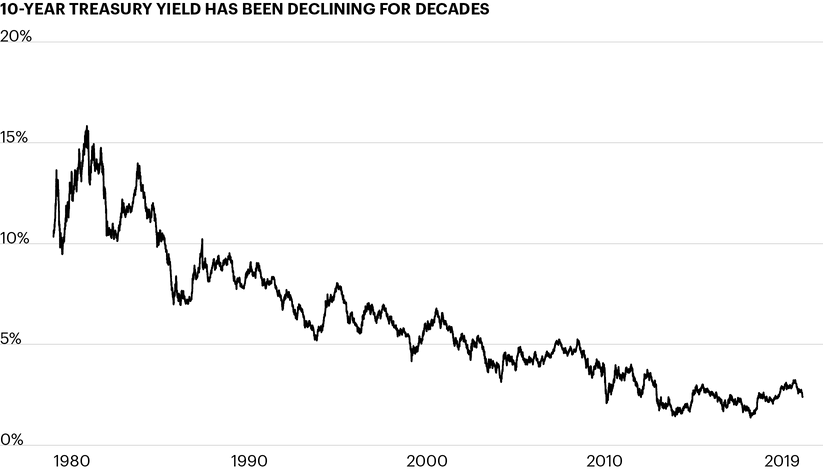

Interest rates have fallen appreciably so far in 2019, with the most recent move down triggered by rapidly shifting Fed rate expectations. Market volatility, policy uncertainty and growth concerns reverberated out the yield curve, pushing long-term yields to 15-month lows and causing the yield curve to invert, a sign of recession that reinforced market unease about the economy.

Source: Macrobond.

Our Fed rate expectations are for no change in 2019, leaving this rate hike cycle stalled – if not stopped completely – at historically low levels of 2.25%–2.50%. But this static outlook does not mean the Fed will disappear from headlines. Markets now place a higher probability of a rate cut in 2019, which we think is premature. Fed-driven volatility could remain at the fore in Q2.

International interest rates have plunged as well, pulling U.S. rates broadly lower. Europe faced an unexpected and sharp deterioration in growth at the end of last year, which caused the European Central Bank (ECB) to postpone rate hike plans. In Japan, growth concerns caused long-term interest rates to return to negative territory. We expect this dynamic to limit any significant gain in U.S. interest rates.

Yield curve inversion will cast a shadow on the economic outlook in Q2. This important harbinger of recession should not be ignored, and we are watching yield curve inversion very closely. We dissect the implications of the flat yield curve as a sign of broader uncertainty and ask whether or not it is too soon to say “this time is different.”

Finally, falling inflation expectations have also put downward pressure on interest rates and reflect both the gloomy growth outlook and the fact that inflation has been largely dormant throughout this expansion. Wage inflation has been creeping higher, however, and needs to be closely watched in Q2. Given the late stage of the economic expansion, wage inflation could be an additional headwind for corporate profits.

A perfect storm of policy uncertainty

Circling around many of the macro factors driving our outlook is policy uncertainty. This acts as both a damper on growth and the spark that could ignite market volatility. We see policy uncertainty as an overarching theme that will remain top of mind throughout 2019.

Uncertainty has already had a noticeable impact on markets and the economy. In the earliest days of 2019, the U.S. government shutdown was arguably the reason consumer confidence fell off its multidecade highs, and the two key indicators have still not recovered end-Q4 levels.

In the U.K., Brexit uncertainties are impacting growth and bleeding through to lower expected growth in Europe. Trade tensions between the U.S. and China could remain a headwind as well, which has negative implications for business investment. Investors need to brace for increased volatility posed by policy uncertainty.

Smooth sailing for high yield, headwinds for equities

The arc of the slowdown will have a significant impact on investors, and the implications for equities and fixed income markets are different.

For equities, volatility will be the overriding feature of markets in 2019. Equities surged in Q1, recovering much of the ground lost in Q4 of last year. And yet, equity markets are careening between tailwinds and headwinds. The global growth slowdown means a challenged outlook for revenue. Late-cycle dynamics are also a headwind, as wages rise and threaten to eat into profits. Granted, a tailwind for market performance could come from continued stock buybacks as corporations retain a significant amount of cash on their balance sheets.

All of this adds up to recurring flare-ups of volatility. Policy remains an overarching uncertainty. Markets have most likely overshot Fed policy expectations to the downside, and as rate cut hopes are priced out, volatility could erupt. Brexit and U.S.-China trade negotiations loom as sources of volatility in Q2, soon to be replaced or supplemented by 2020 election rhetoric. Managing this volatility will be critical for investors.

Fixed income, however, is likely to show a divergence between core fixed income and high yield performance. We see the current environment of declining long-term rates and low corporate defaults as especially conducive for high yield bonds. Falling benchmark interest rates have recently provided a boost to core fixed income investments, but low (or negative) global central bank policy rates mean core fixed income has been beaten into a corner by rates. In this environment, investors need to look beyond the core, and high yield offers an attractive combination of harnessing growth at trend alongside amplified income returns.