The start of any new year can foster hopes for a brighter future – and 2018’s was no exception. The year kicked off with buoyant global growth expectations, giving the Federal Reserve’s rate hike cycle firmer footing and interest rates a modest lift. This sparked hopes that the long income drought may be ending. Yet the link between Fed rate hikes, long-term interest rates and investment income is often weak at best. Higher policy rates have only a fleeting positive impact on traditional fixed income investments. The upshot? Investors looking for income streams to “renormalize” across traditional fixed income asset classes are likely to be in for a longer wait.

Growth and inflation expectations on the move

No one would blame investors for feeling like recent years have left them lost in a low-yield wasteland. The lowest interest rates modern markets have ever seen have been dominating the financial landscape since the Great Recession, with the federal funds rate resting at zero for seven years and the 10-year Treasury trading as low as 1.36% in 2016.1 While equity markets raced higher during the nine-year bull market, most major interest rate benchmarks remained anchored at or near historic lows.

Investors are still awaiting a great renormalization that would bring income generation back to levels seen during the 1990s or 2000s, and 2018 has sparked hope this process is underway. After all, economic data shows improved output and soaring confidence measures. Pro-growth policies on tax cuts and fiscal spending are stoking optimism. Economists and policymakers, in turn, are revising their GDP forecasts higher, causing inflation expectations to rise.2

Such good economic news is strongly impacting the expected Fed rate hike trajectory. Only three quarters ago, the Fed’s growth forecast stood at 2.1%.3 Today it’s at 2.8%.4 Markets have gone from pricing in 44 bps of rate hikes to 107 bps by the end of 2019.5

The weak connection between rate hikes and long-term yields

On the surface, the connection between rate hikes and an improvement in investor income seems straightforward. When the Fed sees growth that’s outpacing the economy’s underlying potential, particularly when the unemployment rate is already low, it raises rates. But how this connects to investor income is more complicated.

The Fed funds rate is an overnight interbank lending rate that investors never actually use, but it is the main driver of short-term interest rates like LIBOR and Treasury bills. At longer maturities, where investors typically look to harvest income, there are multiple competing factors that can influence yield.

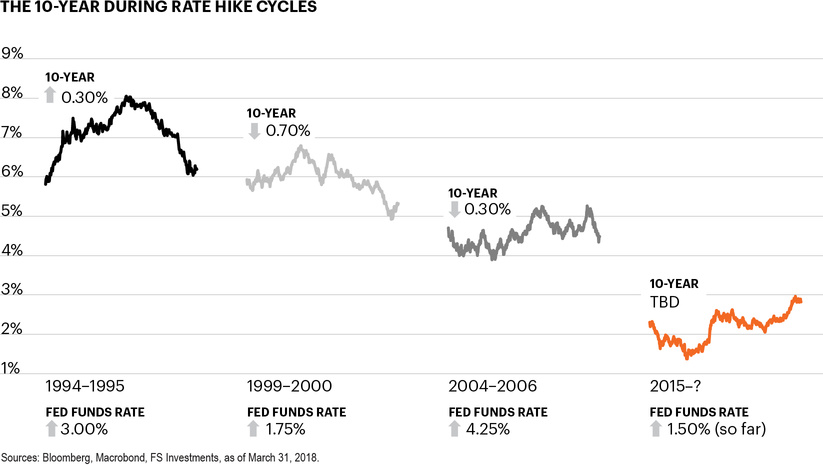

When the Fed engages in a typical rate hike cycle, the 10-year Treasury – the traditional bellwether for most income-oriented investors – often gets little to no boost from even dramatic rate increases. Consider how the relationship has played out over the last several cycles:

- In 1994–1995, the Fed raised rates 300 bps during a 13-month period. Over the first six months, the 10-year yield rose from 5.88% to breach 8%, but quickly reversed. When the cycle ended in July, the yield was only 30 bps above where it had started.

- In the 1999–2000 and 2004–2006 cycles, the Fed raised rates 175 bps and 425 bps, respectively. During both, long-term rates may have risen at some point during the cycle, but in each case the 10-year yield ended at or lower than where it began.

- In the current cycle, the Fed started raising rates in 2015 and has pushed the Fed funds rate up 150 bps, but the 10-year has risen only 70 bps.6

The sources of drag on long-term yields

Two critical patterns emerge when you look at this history. First, long-term yields don’t obediently follow short-term yields. In other words, the Fed funds rate isn’t the rising tide that lifts all ships. During periods of rapid policy-driven short-term rate increases, long-term rates may initially rise, but the increase typically doesn’t last and often fully reverses.

The second critical pattern is a decline in long-term rates over the decades. Since 1982, we see each rate cycle start with lower rates than the previous cycle. Part of this reflects the Fed’s success at anchoring inflation expectations. But much of this multidecade decline in rates reflects the powerful force of demographics. As the baby-boom generation nears retirement, the demand for income-driven “safe” assets has increased, driving prices up and yields down. This is a global phenomenon, and it is affecting rates around the developed world.

Layer onto this other factors that are putting significant downward pressure on interest rates and investor income, like monetary policies at other key central banks. While the Fed is already two years into its rate hike cycle, the European Central Bank (ECB) and the Bank of Japan are continuing to pursue quantitative easing. As a result, 10-year benchmark interest rates are 0.47% in Germany and only 0.05% in Japan,7 significantly lower than in the U.S. The ECB’s quantitative easing involves outright purchases of corporate bonds, which has compressed global investment grade yields.

The way forward in the search for income

For those seeking income from traditional investments, these yield curve acrobatics can seem almost counterintuitive. For example, investment grade corporate bonds currently yield approximately 3.99%, only 34 bps more than when the Fed began raising rates,8 while high yield bond yields are 2.54% below where they were when policy rates started rising.9

Traditional fixed income investors face yet another challenge. The higher an investment’s duration, the more its value is impacted by even a small increase in interest rates. In January 2009 the duration of the Barclays Agg, an investment grade bellwether, was 3.5. That has since risen to 6.1, putting the index value at risk should rates rise even a small amount.

We don’t expect interest rates to surge higher, but if they do, bond funds that have a meaningful allocation to high-duration assets will likely see their value eroded, offsetting benefits gained from slightly higher income.

Instead of passively waiting for income to renormalize as short-term rates rise, investors might consider making their hunt for income more active. That is, looking beyond traditional fixed income to asset classes like real estate or private debt, or to floating rate loans. Floating rate senior secured loans have drawn significant interest this year as investors have increasingly looked for a potential hedge against rising interest rates. Another option is seeking investments that might benefit from volatility. Historically, markets have been subject to periods of significant volatility when the Fed begins tightening. Simply put, investors should keep an eye on rising rates while constructing a portfolio to weather an uptick in volatility and a longer income dry spell.